Sales plunged for Sturm, Ruger, maker of the Mini-14 pictured here and a wide variety of other guns, because dealers overstocked, causing an inventory glut.

Sales plunged for Sturm, Ruger, maker of the Mini-14 pictured here and a wide variety of other guns, because dealers overstocked, causing an inventory glut. NEW YORK (CNNMoney)

Gun dealers have overstocked, and now they're just selling off the inventory that they have, without ordering much from manufacturers.

Gun sales surged to unprecedented levels following the Newtown massacre of December 2012, driven by concerns about increased federal regulations, particularly against assault rifles.

Back then, Americans were buying AR-15s and AK-47s as fast as retailers could get them, pushing up prices and creating shortages of guns and ammo.

The stores couldn't order them fast enough. But they over ordered and now there are too many guns sitting on their shelves.

Sturm, Ruger (RGR) of Southport, Conn., one of the most prominent gunmakers, reported a plunge in sales and profit this week that sent its stock into a tail spin on Thursday. Net sales over three months went to $98 million from $171 million a year ago.

The share price for its rival, Smith & Wesson (SWHC), also took a dive, as investors went sour on gunmakers.

Related: Meet the mom behind Target's gun ban

Sturm, Ruger makes a wide variety of guns, including M4 and Mini-14 military-style rifles, and sells them to distributors, who sell them to stores. It said "retailers [were] buying fewer firearms than they were selling, in an effort to reduce their inventories and generate cash."

This is quite different from 2013 and earlier this year, when Sturm, Ruger CEO Michael Fifer complained about retailers placing "grossly unrealistic" orders with his company.

Fifer called out "that guy with $25,000 worth of credit line hoping he's going to get $100 million worth of product before the surge ended."

To be sure, consumers are still buying guns.

As measured by FBI background checks, more people want to buy guns. The background checks, which are required for most but not all gun transactions, rose in September to 1.46 million, compared to 1.4 million the year before.

In fact, background checks have risen every month since March, compared to last year.

"We are assuming that inventory issues persist with distributors in the near term," wrote CRT Capital analyst Brian Ruttenbur in a market report. "We believe [Sturm, Ruger] will decrease production in 2015 and let inventory work its way through the channel."

He projected that Sturm, Ruger will "dramatically reduce" production next year to 1 million guns, from 1.9 million this year. In this way, the company can avoid having to hold a fire sale.

"We believe management will hold the line on discounts and therefore preserve margins at reasonable levels," he said.

Related: Gun violence costs taxpayers $500 million

Related: Guns welcome at Shooters Grill

First Published: October 31, 2014: 9:57 AM ET

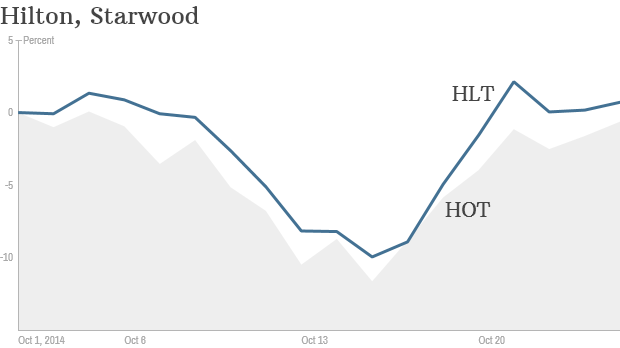

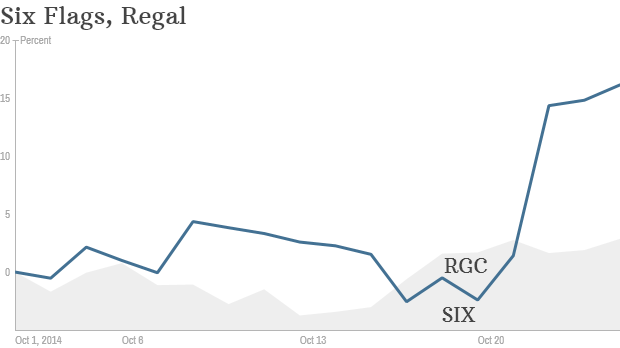

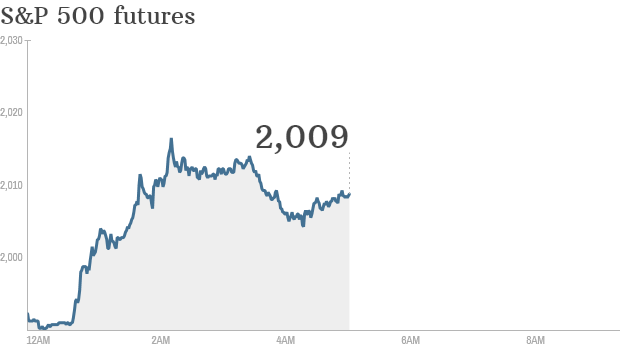

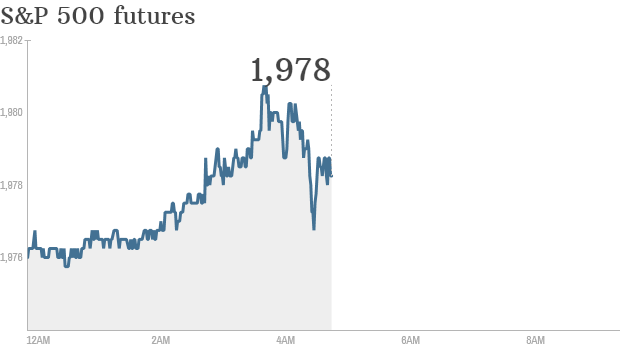

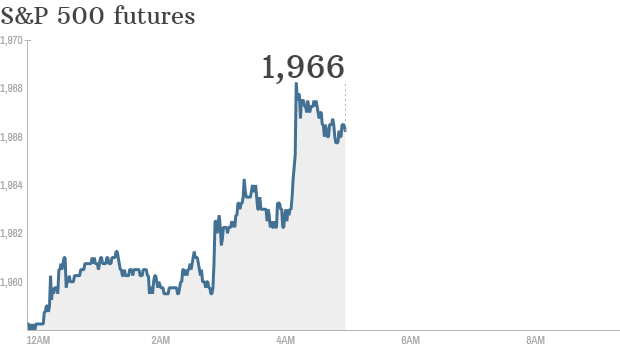

Click chart for in-depth premarket data.

Click chart for in-depth premarket data.  Apple warned investors it could be hit by higher taxes due to changes in Irish law

Apple warned investors it could be hit by higher taxes due to changes in Irish law  This man wore his Google Glass to a premiere of "Sex Tape," an act that was banned this week by industry groups representing movies and theaters.

This man wore his Google Glass to a premiere of "Sex Tape," an act that was banned this week by industry groups representing movies and theaters.

The furry shoe from Giuseppe Zanotti sells for $1,395. Alejandro Ingelmo's Tron Leopard Bronze costs $575.

The furry shoe from Giuseppe Zanotti sells for $1,395. Alejandro Ingelmo's Tron Leopard Bronze costs $575.  The 'Jeddi Snake' shoe costs $750

The 'Jeddi Snake' shoe costs $750

The explosion of an unmanned rocket from Orbital Sciences late Tuesday has investors running for the exits.

The explosion of an unmanned rocket from Orbital Sciences late Tuesday has investors running for the exits.  Illinois Gov. Pat Quinn, a Democrat, is running for re-election and backs a non-binding ballot measure that would impose a millionaire tax to help support schools.

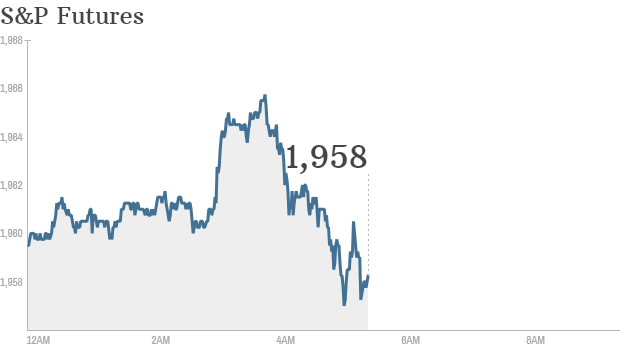

Illinois Gov. Pat Quinn, a Democrat, is running for re-election and backs a non-binding ballot measure that would impose a millionaire tax to help support schools.  Click chart for in-depth premarket data.

Click chart for in-depth premarket data.  The recall covers Dodge Ram truck models 2500, 3500, 4500 and 5500, Chrysler said.

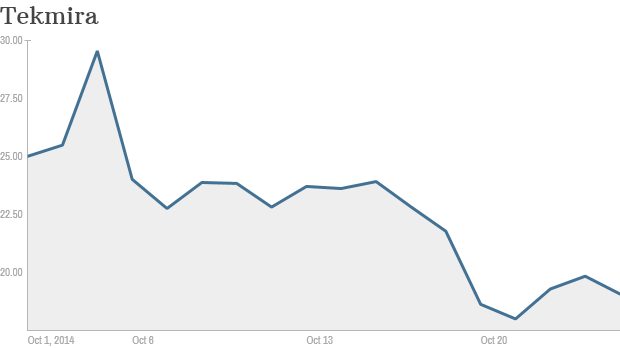

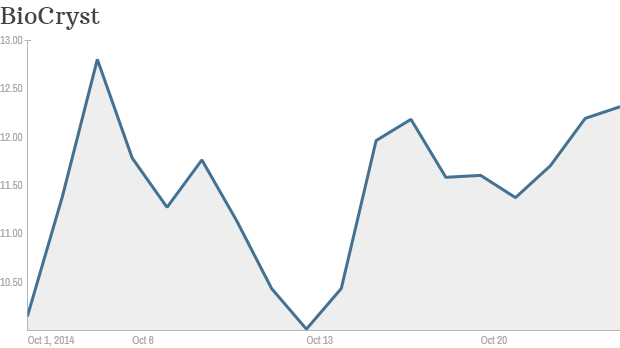

The recall covers Dodge Ram truck models 2500, 3500, 4500 and 5500, Chrysler said.  Researchers at the University of Utah are working on an Ebola treatment.

Researchers at the University of Utah are working on an Ebola treatment.  Expect the parking lot at Costco to be empty on Thanksgiving this year.

Expect the parking lot at Costco to be empty on Thanksgiving this year.  Click chart for in-depth premarket data.

Click chart for in-depth premarket data.  Federal prosecutor Preet Bharara is suing New York City and Computer Sciences Corp. for Medicaid fraud.

Federal prosecutor Preet Bharara is suing New York City and Computer Sciences Corp. for Medicaid fraud.

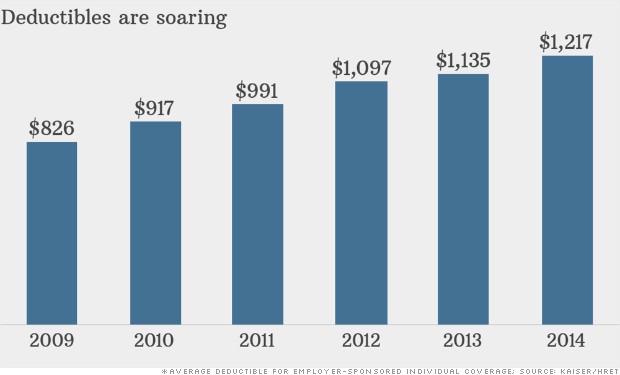

Medical care has become more costly for the Vance family under a high-deductible plan.

Medical care has become more costly for the Vance family under a high-deductible plan.  Click chart for in-depth premarket data.

Click chart for in-depth premarket data.

Musician Eric Clapton helped design this original Ferrari. It's one of a kind and estimated to be worth millions.

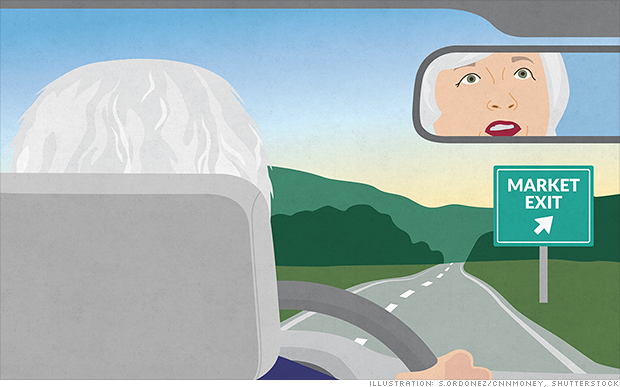

Musician Eric Clapton helped design this original Ferrari. It's one of a kind and estimated to be worth millions.  Fed Chief Janet Yellen is preparing to get off the road of economic stimulus.

Fed Chief Janet Yellen is preparing to get off the road of economic stimulus.  Some banks are still feeling the effects of the last financial crisis.

Some banks are still feeling the effects of the last financial crisis.  The Senate race in Iowa, in which Republican Joni Ernst is running against Democrat Bruce Braley, could help the GOP retake the Senate majority in the midterm elections.

The Senate race in Iowa, in which Republican Joni Ernst is running against Democrat Bruce Braley, could help the GOP retake the Senate majority in the midterm elections.