NEW YORK (CNNMoney)

According to early estimates on Black Friday from Shoppertrak, sales at brick-and-mortar stores were down slightly to $12.29 billion in 2014 vs. $12.35 billion a year earlier. But spending was up nearly 24% on Thanksgiving, and slipped 6.9% on Black Friday, Shoppertrak found.

What's more, people were more willing to trek to stores on Thanksgiving: Visits were up 27% on Thursday compared to 2013, but they were down 5.6% on Black Friday, according to Shoppertrak.

Still, shoppers spent nearly three times as much -- $9.1 billion -- on Black Friday than on Thursday, Shoppertrak estimates.

The trend was similar online, with shoppers increasingly willing to buy on Thanksgiving. Online sales were up 14.3% on Turkey Day compared to last year, according to IBM's Digital Analytics Benchmark report, but just 9.5% on Black Friday, less than expected.

Shoppers also are using their phones and tablets more than ever -- both to buy and comparison-shop while in stores, IBM found.

Sales on mobile devices were up more than 28% from Black Friday last year, accounting for more than one in four online sales transactions Friday, IBM found.

IBM had projected online shopping would climb 15% for the period from Thanksgiving through Monday. It projected year-over-year growth of 13% on Black Friday.

Gas prices drop could mean happier holidays

Wal-Mart (WMT), the world's largest retailer, said it shattered sales records on Thanksgiving, posting its second-biggest online sales day. The company said its site saw over 500 million page views, and 70% came from mobile traffic.

Overall, the National Retail Federation projected spending this season will climb 4.1% to $616.9 billion. It estimated online sales would grow between 8% and 11%.

Last year, holiday sales climbed 3.1%, according to the NRF.

Related: 24 hours with a Black Friday worker

The preliminary reports from Shoppertrak and IBM give an early peek at some of the busiest shopping days of the year.

Black Friday isn't the one-day event that it used to be, when malls and department stores threw open their doors at midnight.

Nowadays, there's round after round of "door busters" and a slew of online sales that begin days before Friday. And most major retailers advertise "Black Friday" deals that actually begin Thanksgiving Thursday evening.

First Published: November 29, 2014: 7:05 PM ET

This year's Macy's Thanksgiving Day Parade brought in over 22 million viewers for NBC.

This year's Macy's Thanksgiving Day Parade brought in over 22 million viewers for NBC.  Junk bonds provide an early warning sign for Wall Street.

Junk bonds provide an early warning sign for Wall Street.  Protesters marched in D.C. Friday morning.

Protesters marched in D.C. Friday morning.

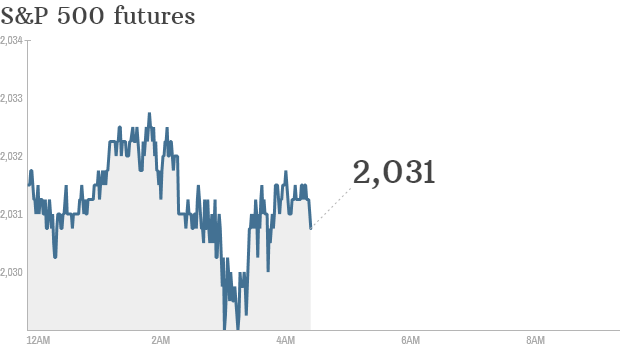

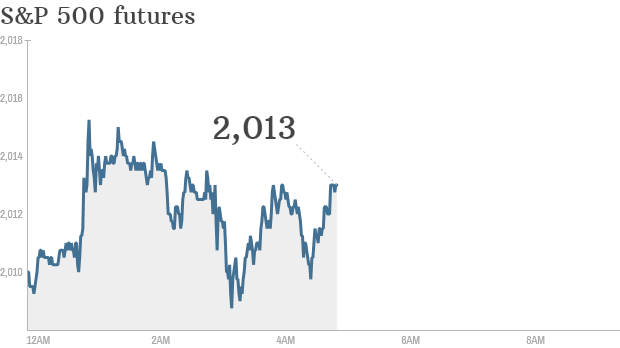

Click chart for in-depth premarket data.

Click chart for in-depth premarket data.  Facebook is launching a fundraising campaign to help groups fighting Ebola.

Facebook is launching a fundraising campaign to help groups fighting Ebola.  A report on Luxembourg's role as a tax haven will make uncomfortable reading for the country's former prime minister, Jean-Claude Juncker -- now the EU's top official.

A report on Luxembourg's role as a tax haven will make uncomfortable reading for the country's former prime minister, Jean-Claude Juncker -- now the EU's top official.

Dina Wilcox and Ann Fry live together in an apartment in Harlem.

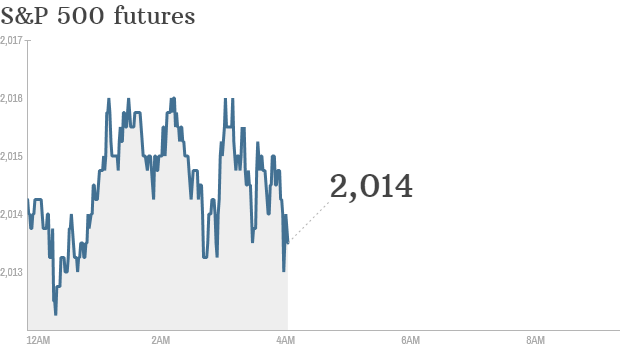

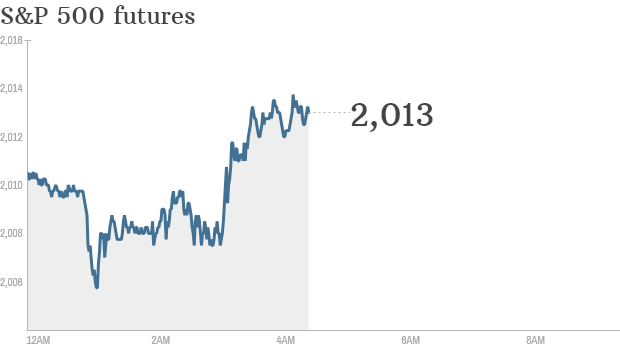

Dina Wilcox and Ann Fry live together in an apartment in Harlem.  Click chart for in-depth premarket data.

Click chart for in-depth premarket data.  CEOs think that it's all good even though there are many concerns about the global economy.

CEOs think that it's all good even though there are many concerns about the global economy.  Voters in Berkeley, California passed a tax on sugary soda while a similar measure failed to pass in San Francisco.

Voters in Berkeley, California passed a tax on sugary soda while a similar measure failed to pass in San Francisco.

Click chart for in-depth premarket data.

Click chart for in-depth premarket data.

Wall Street isn't digging the Democratic party right now.

Wall Street isn't digging the Democratic party right now.