NEW YORK (CNNMoney)

Ever since the movie studio was crippled by a cyberattack on Nov. 24, it has been on the defensive. Last week, after hackers objecting to the content of "The Interview" threatened American moviegoers, Sony (SNE) canceled the movie's Christmas day release in 3,000 theaters from coast to coast.

But now the scandalous Seth Rogen comedy has been resurrected. Yesterday it went on sale on the Internet. Today it's coming out in 331 independently owned movie theaters, some of which have already reported sell-out crowds -- perhaps the best Christmas gift Sony could have wished for.

Rogen showed up at a midnight screening in Los Angeles to celebrate the movie's unlikely release. "If it wasn't for theaters like this and people like you, this wouldn't be" happening, Rogen said, adding an expletive for good measure.

Related: Sony Streams 'The Interview' online

A few hours later, the movie opened at the Cinema Village theater in the Greenwich Village neighborhood of New York City. Some of the film's fans waiting in line said "The Interview" wasn't just holiday entertainment, but a "patriotic duty" in defense of freedom of expression.

"It is a celebration of the constitution. It's very important to show that any idea can be expressed," said Willie Jasso, who was first in line.

The comedy, which has received mixed reviews, is about an assassination plot against the North Korean dictator Kim Jong-Un. It is widely believed that the cyberattack was partly related to North Korea's fury over the movie, which the country has called an "act of war" by the United States. Hackers invoked 9/11 in a Dec. 16 message warning Americans to stay away from theaters playing the movie.

But on Thursday morning the mood at Cinema Village was festive rather than fearful.

"It did not seem like a credible threat anyone could carry out, and now it's even less likely," said Mark Rosenzweig, another patron at the theater.

The FBI and local law enforcement have worked with movie theaters on steps to ensure security at screenings of the movie.

Top-selling movie rental on YouTube

While some movie buffs lined up on Christmas morning, many others shrugged off the release -- and that's a point that a spokesman for President Obama made in a statement on Wednesday.

"People can now make their own choices about the film, and that's how it should be," White House deputy press secretary Eric Schultz said.

So now the question becomes: how many people will really pay to see "The Interview?"

It's too soon to know how many tickets have been sold. And a Sony spokesman reaffirmed on Thursday morning that the company will not be releasing any immediate data about the number of online rentals.

The movie is available for a $5.99 rental through YouTube, Google (GOOGL, Tech30) Play, Microsoft's (MSFT, Tech30) Xbox video store, and a special web site set up by a startup called Kernel.

The sites do not provide video view counts for movie rentals, but on Thursday morning "The Interview" was listed as the No. 1 seller on YouTube and Google Play.

Related: Watching 'The Interview' online: absurdly amusing

Kernel said there was "tremendous demand" shortly after the 1 p.m. ET release on Wednesday.

"Tremendous" is the same word that Charles Roark, the owner of the Hollywood Cinema in Martinsville, Va., used to describe anticipation for "The Interview."

"We are one of only two theaters in Virginia to get the movie, and the phones have been ringing off the hook for advanced sales, as well as customers flooding the doors," he said, calling sales "more brisk than nearly any previous movie we've ever shown."

'Essential' for this movie to come out

The simultaneous physical and digital release plan was stitched together in recent days. It came over the objections of some of the big movie theater chain owners, which are reluctant to have movies rented on the Internet while they're still on big screens.

A spokesman for the National Association of Theater Owners declined to comment.

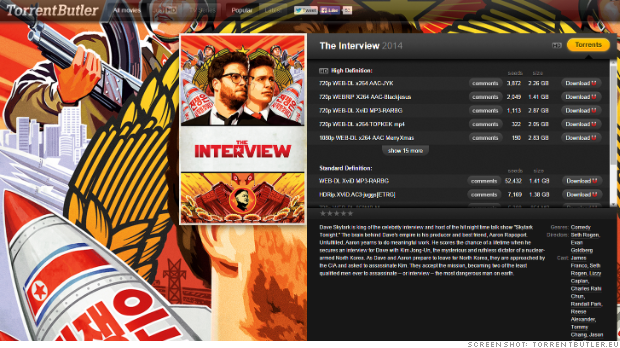

One of the chain owners' concerns is pirating, and sure enough, "The Interview" started to show up on illegal file-sharing websites by Wednesday night. The New York Times reported that a Chinese-subtitled version has the title translated as "Assassinate Kim Jon-un."

The smaller theaters that agreed to show the movie Thursday were aware of the digital distribution plan ahead of time.

Steve Mason, a co-owner of the Cinémas Palme d'Or in Palm Desert, Calif., said he had been requesting to show "The Interview" ever since the big movie chains backed away from plans to release it last week.

His cinema now has two showings of the movie on Thursday evening.

"Independent theaters are fearless. We are in it for the love of film," Mason said in an email to CNNMoney. "We would never back down from showing this movie or any other one."

Michael Lynton, the Sony Pictures CEO, sounded similarly confident in a video message to staff on Wednesday that was obtained by CNN.

"It was essential for our studio to distribute this movie, especially given the assault on our business and on our staff," Lynton said.

"This film represents our commitment to our filmmakers and free speech," he added. "While we couldn't have predicted the road this movie traveled to get to this moment, I am proud our fight was not for nothing, and that cybercriminals were not able to silence us."

Lynton also emphasized that "we continue to seek other partners and platforms to further expand the release."

Those other partners could be the big chains, or they could be digital distributors like Netflix (NFLX, Tech30).

A Sony spokesman declined to comment Thursday on reports that Netflix might stream the movie to its subscribers in the coming weeks or months.

--CNN's Pamela Brown and Rosa Flores contributed reporting.

First Published: December 25, 2014: 12:09 PM ET

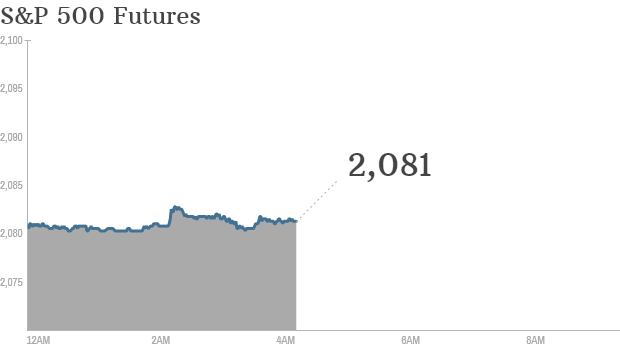

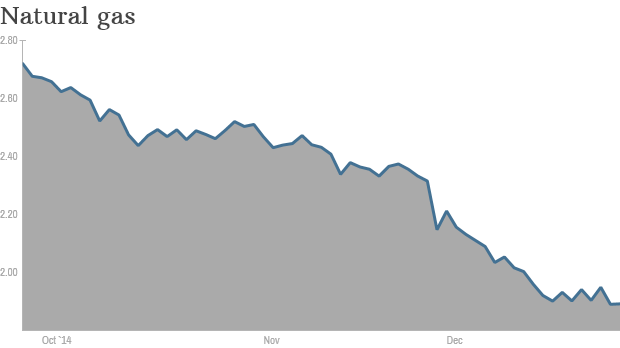

Click on the chart for in-depth market data.

Click on the chart for in-depth market data.

Russian President Vladimir Putin is known to enjoy his vodka with high-powered friends, including Chinese President Xi Jinping.

Russian President Vladimir Putin is known to enjoy his vodka with high-powered friends, including Chinese President Xi Jinping.  Behold the official Waterford Crystal New Year's Eve ball at its home atop One Times Square in New York City.

Behold the official Waterford Crystal New Year's Eve ball at its home atop One Times Square in New York City.

Hackers recreated the thumbprint of German Minister of Defense Ursula von der Leyen using several news photos.

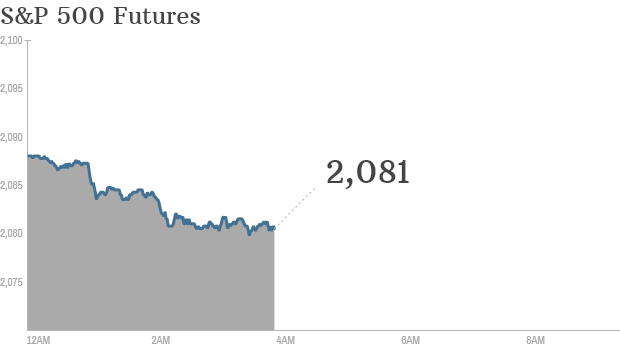

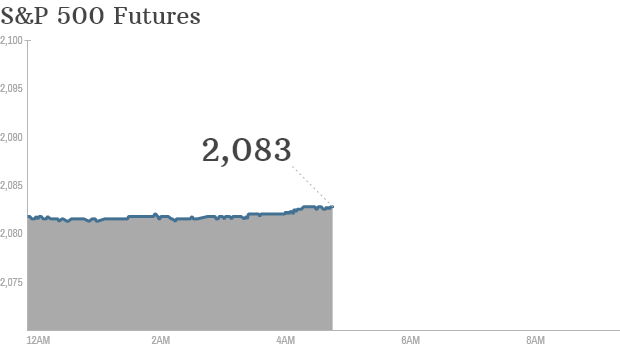

Hackers recreated the thumbprint of German Minister of Defense Ursula von der Leyen using several news photos.  Click chart for in-depth premarket data.

Click chart for in-depth premarket data.  Gmail activity has flatlined in China. Is the Great Firewall to blame?

Gmail activity has flatlined in China. Is the Great Firewall to blame?  Polls show the anti-austerity party Syriza could win the most voter support during upcoming elections in Greece.

Polls show the anti-austerity party Syriza could win the most voter support during upcoming elections in Greece.

Former Atlanta Falcons running back T.J. Duckett struggled to find his way after leaving the NFL but now he's running his own nonprofit.

Former Atlanta Falcons running back T.J. Duckett struggled to find his way after leaving the NFL but now he's running his own nonprofit.  Better fiscal policy should make global investors happier in 2015.

Better fiscal policy should make global investors happier in 2015.  A lot of old American cars in Cuba, like this 1957 Ford Fairlane, are now used as taxi cabs.

A lot of old American cars in Cuba, like this 1957 Ford Fairlane, are now used as taxi cabs.  Often, cars like this 1957 Chevrolet Bel Aire, have engines taken from later European cars.

Often, cars like this 1957 Chevrolet Bel Aire, have engines taken from later European cars.  The emphasis is on keeping cars like this 1952 Chevrolet running not on keeping them in original condition.

The emphasis is on keeping cars like this 1952 Chevrolet running not on keeping them in original condition.  Cars like this 1952 Buick are often passed down through families.

Cars like this 1952 Buick are often passed down through families.  This is a 1952 Plymouth but little of the original car may remain underneath.

This is a 1952 Plymouth but little of the original car may remain underneath.  This 1958 Ford Prefect was a model not sold in the United States.

This 1958 Ford Prefect was a model not sold in the United States.  This 1951 Chevrolet has clearly been through some changes.

This 1951 Chevrolet has clearly been through some changes.  In her normal professional life, Brenda Priddy takes photographs like this one of a Chevrolet Silverado being tested in the desert before it had been unveiled to the public.

In her normal professional life, Brenda Priddy takes photographs like this one of a Chevrolet Silverado being tested in the desert before it had been unveiled to the public.  At issue in NYC is whether polystyrene, commonly known as Styrofoam, can be effectively recycled in a way that doesn't cost too much.

At issue in NYC is whether polystyrene, commonly known as Styrofoam, can be effectively recycled in a way that doesn't cost too much.  Jim Beam Leathers was born on November 14, to Jack Daniels Leathers and Lydia Leathers.

Jim Beam Leathers was born on November 14, to Jack Daniels Leathers and Lydia Leathers.

"The Interview" has been downloaded on sites like TorrentButler thousands of times.

"The Interview" has been downloaded on sites like TorrentButler thousands of times.  Click on the chart for more market data

Click on the chart for more market data