Apple warned investors it could be hit by higher taxes due to changes in Irish law

Apple warned investors it could be hit by higher taxes due to changes in Irish law NEW YORK (CNNMoney)

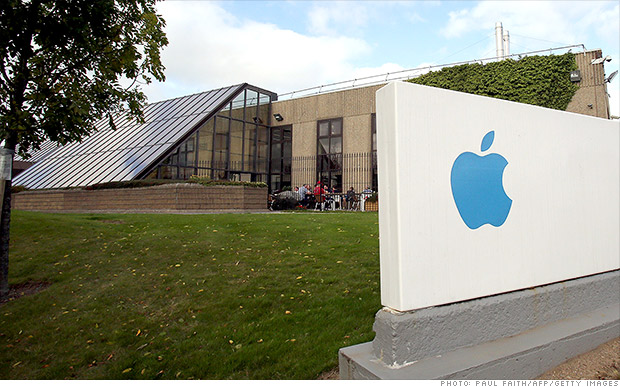

In June, the European Commission started investigating whether Apple's 1991 tax deal with Ireland violated European Union laws prohibiting state aid to companies. In September it ruled against the tax deal. Ireland and Apple are fighting the decision.

In the company's annual financial report, released this week, Apple warned investors that "If the Company's effective tax rates were to increase, particularly in the U.S. or Ireland...the company's operating results, cash flows and financial condition could be adversely affected."

Related: How Apple socres its lower tax bill

Apple (AAPL, Tech30) has paid as little as 2% on profits attributed to its subsidiaries in Ireland, well below the 35% top rate in the United States and even well below Ireland's 12.5% rate. That has prompted complaints by both European and U.S. lawmakers. CEO Tim Cook was even called to testify on Apple's tax deal before a Senate committee.

Ireland announced earlier this month that it would end a key tax break for tech companies by 2020

But some experts say the change is more of a public relations move than a step that will significantly increase the taxes those companies have to pay.

Related: Is Apple the perfect stock?

First Published: October 31, 2014: 7:40 AM ET

Anda sedang membaca artikel tentang

Apple says it may lose Irish tax break

Dengan url

http://sepakgajah.blogspot.com/2014/10/apple-says-it-may-lose-irish-tax-break.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Apple says it may lose Irish tax break

namun jangan lupa untuk meletakkan link

Apple says it may lose Irish tax break

sebagai sumbernya

0 komentar:

Posting Komentar