How a $35 PC is catching on

Written By limadu on Kamis, 28 Februari 2013 | 21.29

Jobless claims fall sharply

Those filing for initial jobless claims falls sharply, an unexpected sign of improvement in the labor market.

NEW YORK (CNNMoney)

The Labor Department report showed 344,000 Americans filed for jobless benefits in the latest week, down from 366,000 the previous week. Economists surveyed by Briefing.com had forecast 360,000 would be seeking help in the latest report.

The average number of people seeking help over the past four weeks totaled 355,000, down 6,750 from the four-week average the previous week. Economists prefer to look at the four-week average to smooth out the impact of short-term blips that can be caused by weather and other special events.

Related: Unemployed would lose benefits if federal budget cuts go through

Overall, average claims are down about 3% from where they were a year ago. They've largely been hovering in the 330,000 to 375,000 range for the last three months -- a level that seems to be consistent with the U.S. economy adding about 180,000 jobs each month. But that's barely enough to keep up with population growth and not enough to make a significant improvement in reducing the unemployment rate.

In addition to counting first-time claims, the Labor Department also tracks people who have filed for their second week or more of benefits. The latest data show 3.1 million people filed continuing claims during the week ended February 16, an 91,000 decrease from a week earlier, and down nearly 10% from those receiving longer-term help a year ago. ![]()

First Published: February 28, 2013: 8:53 AM ET

BMW gets plugged in

(Fortune)

The second vehicle, an all-electric city car called the i3, is unlike anything BMW -- or anyone else, for that matter -- has ever made. Its weight-saving carbon-fiber body is wrapped in layers of electronic services and smartphone apps designed to make life simpler and save time for the owner. Searching for a parking space? The i3 will help you find one at your destination -- as well as arrange to rent out your space at home while you are gone. Need a charge for the lithium-ion batteries? Another feature locates the nearest charging station and arranges for an emergency boost if you can't find it. Should you be planning a trip out of town, BMW will help you swap your electric car for a gasoline-powered one with a longer range.

Europe to cap bankers' bonuses

U.K. bankers' bonuses will be capped by new EU rules.

LONDON (CNNMoney)

The measure, which could take effect as early as January 2014, will limit bonuses to the level of annual salary, or twice salary given the approval of a majority of shareholders. The cap will apply globally to European Union banks, and to international banks operating within the EU.

"This is the objective of the cap, to stop short term risk taking," European Commissioner Michel Barnier said at a news conference.

The cap is part of a broader package of rules requiring banks to hold higher amounts of capital to protect them from future shocks, set aside more funds to ensure liquidity in times of crisis and to be more transparent about their businesses.

"This overhaul of EU banking rules will make sure that banks in the future have enough capital, both in terms of quality and quantity to withstand shocks," said Irish finance minister Michael Noonan, who helped broker the deal between representatives of EU states and the European Parliament. "This will ensure that taxpayers across Europe are protected into the future."

A majority of the 27 European Union states must back the provisional agreement for it to become law and further changes may yet be negotiated.

The U.K. has resisted the cap on bonuses, worried that it may drive bankers out of London, Europe's financial capital.

Banks have already been forced to change the way they structure bonuses, paying them out over a longer period of time and adding claw-back arrangements. Some responded by increasing base pay, saying they risked losing top performers.

But this is the first EU cap on bonus size and reflects political frustration that big banks continue to pay millions to some employees while many incomes are dropping as governments and firms are forced to tighten their belts.

A series of high-profile scandals -- including market rigging, money laundering and mis-selling of products -- has fueled public anger at the apparent lack of restraint in setting bonuses for top bankers.

Related: Barclays CEO: I don't deserve a bonus

Businesses argue that markets should be allowed to determine levels of pay, and that companies should be treated no differently than the movie industry or sports clubs that pay top dollar for top talent.

The Confederation of British Industry, a business lobby group, has warned that an EU bonus cap could translate into higher levels of base pay, weakening the link between performance and reward -- the opposite of the desired effect.

The CBI has also warned that capping the variable element of bankers' pay would limit banks' ability to reduce costs in response to weaker markets.

But the new rules may do little more than reflect the reality for many now working in financial services. Bonuses have fallen due to a sharp drop in activity and employment.

Related: Wall Street CEOs: Who's paid the most?

The Center for Economics and Business Research estimates that bonuses in London totaled about £1.6 billion in the latest round, down from £11.6 billion in 2008.

Wall Street bonuses have also fallen since the bumper years of 2008 and 2009, when New York bankers enjoyed a share of $22 billion each year, but they are rising again. Average cash bonuses rose by 9% last year to nearly $122,000, and the total pot was up 8% at $20 billion. ![]()

First Published: February 28, 2013: 4:02 AM ET

Boeing apologizes for Dreamliner fiasco

LONDON (CNNMoney)

Raymond Conner, head of the commercial aircraft division at Boeing (BA, Fortune 500), said the incidents that led to the grounding of the entire fleet of Dreamliner 787 planes were "deeply regretful".

"On behalf of the Boeing Company and the 170,000 people which I represent today, I want first to apologize for the fact that we've had two incidents with our two very precious customers, ANA and JAL," he told reporters in Tokyo.

Between them, All Nippon Airways and Japan Airlines operate nearly half the 50 Dreamliners delivered to customers so far.

The Dreamliner has sold well in Asia and the Middle East, where airlines depend on long-range flights for much of their business and can benefit most from the improvements in fuel economy the lighter-weight plane promises.

Related: Boeing's latest problem: Strike threat

The grounding last month due to fires linked to the use of lithium-ion batteries has forced Japan's airlines to cancel hundreds of flights, costing millions in lost revenue. Boeing has warned customers of delays to deliveries, although it continues to make the plane.

The new plane is at the heart of ANA's strategy, and if it remains out of service for an extended period of time, the damage to the airline could be significant. ANA has already said it will seek compensation from Boeing.

Conner said Boeing had hundreds of engineers working with external experts on the battery technology to come up with a solution that addresses all the possible causes of the incidents that led to the grounding.

"What we did today was discuss the solutions that we are looking at that could be the final solution to get airplane back in air flying again," he said.

The problems with the new battery technology have already prompted Boeing's European rival Airbus to revert to standard nickel-cadmium batteries in its A350 plane, designed to compete with the Dreamliner and due to make its first test flight in the middle of this year.

![]()

First Published: February 28, 2013: 5:59 AM ET

Stocks: Economy, earnings back in focus

Click on chart for more premarket data

NEW YORK (CNNMoney)

The Labor Department will release its weekly report on initial jobless claims at 8:30 a.m. ET, while the Commerce Department will publish its second estimate of fourth-quarter GDP.

In its initial estimate last month, the Commerce Department said the economy contracted at an annual rate of 0.1% in the fourth quarter, the first contraction since the second quarter of 2009.

On the corporate front, the department store chain Sears Holdings (SHLD, Fortune 500) reported earnings, showing that sales at stores open a year or more notched up 0.8% in the fourth quarter but fell 1.4% for the year. The company said that it has closed 300 Sears and Kmart stores, or 13% of its total, since 2006.

Barnes & Noble (BKS, Fortune 500), the book retailer, is also set to report quarterly results in the morning, while Gap (GPS, Fortune 500) is up after the bell.

U.S. stock futures were steady.

Fear & Greed Index: Greed is good

U.S. stocks rose Wednesday to a five-year high as investors welcomed more upbeat housing data and a second day of dovish testimony from Federal Reserve chairman Ben Bernanke. The Dow rose 1.2% to finish at its highest level since October 2007.

J.C. Penney (JCP, Fortune 500) shares plunged in premarket trading as the retailer reported a dismal fourth-quarter loss and weak same-store sales.

Groupon (GRPN) shares plunged 26% in premarket trading after the daily deals site's results missed already low expectations.

Shares of Sturm, Ruger (RGR) rose in after-hours trading as the gun maker reported earnings that beat expectations. The company benefited from a surge in firearm sales on fears of new gun-control laws following the re-election of President Obama and the shooting in Newtown, Conn.

European markets rose in midday trading, drawing support from comments from European Central Bank President Mario Draghi that suggested the bank had room to relax policy further. Meanwhile, the European Union is planning to cap bankers' bonuses to rein in reckless risk taking.

Asian markets had a banner day. After the nomination of Haruhiko Kuroda to be Japan's next central banker, the Nikkei posted a 2.7% increase to its highest point since 2008. The Shanghai Composite rose 2.3% and the Hang Seng added 2%. ![]()

First Published: February 28, 2013: 4:41 AM ET

Variety nix print edix

Written By limadu on Rabu, 27 Februari 2013 | 21.29

NEW YORK (CNNMoney)

The publication, founded in 1905, also announced it is dropping the paywall from its online edition this Friday, which limited the readership of its articles to subscribers.

"Internally, we've been referring to the paywall dropping as 'the end of an error,'" said Jay Penske, chairman and CEO of Penske Media Corporation, which together with hedge fund Third Point purchased the newspaper last year from Reed Elsevier (ENL).

The new weekly version of the print edition will debut March 26, said the company. The announcement did not say whether there would be any staff cuts as a result of the move. It also announced that its editor-in-chief post would now be shared by three people, naming Claudia Eller, Cynthia Littleton and Andrew Wallenstein to the joint post and marking the first time a woman has held the editor-in-chief title at the paper.

Related: Record year for Hollywood box office

Variety is well known in Los Angeles and New York for its coverage of movies, television, theater and music. It also is known for its clever headlines. A 1935 headline, "Sticks nix hick pix," on a story about how rural audiences don't like movies about rural life, is considered one of the most famous headlines on any U.S. newspaper.

Traditional print media has been struggling in recent years as both readers and advertisers have shifted to online media. The costs involved in publishing a print edition, including newsprint and delivery expense, have prompted some other daily newspapers to drop some of their print editions. Notable among them is the New Orleans Times-Picayune, which dropped its print schedule to three times a week last year.

In December, the news weekly Newsweek dropped its print edition and is now only published online. ![]()

First Published: February 27, 2013: 7:33 AM ET

Italy avoids panic at bond auction

LONDON (CNNMoney)

Panic was avoided and the bond auction passed off smoothly as the heavily-indebted eurozone country found solid demand for €6.5 billion worth of medium and long-term debt.

One day earlier, world stocks plunged and yields on southern European debt rose sharply as Italian voters elected a hung parliament and backed the anti-establishment, anti-austerity party of comedian Beppe Grillo in far greater numbers than expected.

Early Wednesday, the Italian government sold €4 billion of new 10-year bonds at a yield of 4.83%, up from 4.17% at a previous auction in January but below the levels hit soon after the final election results were released. Italy also sold €2.5 billion of 5-year debt at 3.59%, up from 2.94% last month.

Italy sold all the bonds offered and at a lower premium than some analysts had feared given the uncertain political backdrop. And despite rising strongly this week, yields remain well below the 6.5%-7% peaks seen at the height of the eurozone debt crisis in 2011 and 2012.

European stock markets clawed back some of Tuesday's losses and the euro was firmer against the dollar.

Market confidence in the eurozone was restored last year after the European Central Bank said it would stand behind ailing member states, offering to buy their bonds provided they agreed to fiscal discipline and economic reforms.

Related: Italy faces deadlock after divided vote

For that to work, eurozone states clearly need a stable government committed to a path of reform. Wednesday's auction suggests investors are prepared to give Italy more time to find a way out of the mess left by the election.

"The higher yield shows that sovereign debt is caught in a tug of war between the reassurance provided by the ECB and the growing confusion and instability in Italian politics," said Nicholas Spiro, managing director of Spiro Sovereign Strategy.

"For the time being the former continues to hold sway but the latter is now putting up some fairly stiff competition -- this is no longer a one-way bet," he added.

Related: Italy's election mess won't knock out Europe

Italy needs to sell about €420 billion in 2013. The country had already met about 25% of that requirement before Wednesday's auction, taking advantage of more favorable market conditions in the last couple of months.

The country has accumulated about €2 trillion of debt, equivalent to some 127% of gross domestic product, the second-highest ratio in the eurozone after Greece.

Latest forecasts from the European Commission suggest Italy is on track to begin reducing that mountain of debt next year but for that to become a sustainable trend, the country badly needs to continue an economic overhaul begun over the past 12 months. That's unlikely to happen anytime soon given the political stalemate in Rome.

"It will be important to keep an eye on the rating agencies, who could well jangle nerves with another downgrade if policy uncertainty in Italy persists," noted Tristan Cooper, sovereign debt analyst at Fidelity, adding the negative market reaction to the election could provide an opportunity to buy into peripheral eurozone debt at higher yields. ![]()

First Published: February 27, 2013: 8:09 AM ET

Yahoo defends no-work-at-home policy

NEW YORK (CNNMoney)

"This isn't a broad industry view on working from home -- this is about what is right for Yahoo, right now," said a statement from a company spokesman late Tuesday.

The no-work-at-home policy has prompted widespread criticism since it was unveiled in an e-mail to employees on Monday from Jackie Reses, the new head of human resources at the company who was brought in by CEO Marissa Mayer.

"To become the absolute best place to work, communication and collaboration will be important, so we need to be working side-by-side," said the e-mail. "That is why it is critical that we are all present in our offices."

Yahoo (YHOO, Fortune 500) did not say how many of the 11,500 employees currently work from home full time, saying it won't comment on "internal matters."

Many have criticized the move as damaging to morale, saying it could even chase away valuable employees.

"We like to give people the freedom to work where they want, safe in the knowledge that they have the drive and expertise to perform excellently, whether they're at their desk or in their kitchen," wrote Virgin Group CEO Richard Branson on his blog. "Yours truly has never worked out of an office, and never will."

Others have said that even if there is justification for the policy, the way it was announced, in an e-mail and without comment from Mayer or other executives, was a mistake.

"The new HR policy is shocking in its extreme measure and harsh delivery," wrote Fortune's Patricia Sellers. "The main problem is how the new rule got communicated."

--CNNMoney's Julianne Pepitone contributed to this story. ![]()

First Published: February 27, 2013: 8:20 AM ET

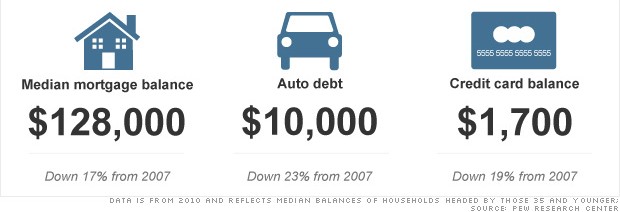

Young adults are too broke to get loans

Young adults have reduced their debt levels throughout the Great Recession.

NEW YORK (CNNMoney)

It's not because legions of Americans under age 35 have suddenly become fiscally responsible. It's more likely that their shaky economic foundations either prevent them from qualifying for a loan or even thinking about applying for one, according to those studying the trend.

"It's a sign of economic struggle, not economic success," said Richard Fry, senior economist at the Pew Research Center. "They don't have the mortgage, but they don't have the house."

The center found that young adults' debt levels dropped nearly 14% between 2001 and 2010, while rising 63% for those age 35 and older, according to a recent Pew study.

The real-world ramifications are eye-popping. The share of younger households owning their primary residence fell to 34% in 2011, down from 40% in 2007. Only 66% owned or leased at least one vehicle in 2011, down from 73% four years earlier, as car loans plunged. Credit card balances have also fallen.

The only debt on the rise is student loans. In 2007, just over a third of young households had outstanding student debt. That jumped to 40% in 2010.

One reason for the decline is the weak job market, especially for the young. Their unemployment rate was more than 2 percentage points higher than their older peers in 2010 and 2011, according to federal labor statistics. Many of those lucky enough to have employment either make less than they expected or are concerned about getting laid off.

"Young people have less debt because they are less likely to live the American Dream -- own a home, buy a car, start a family," said Evan Feinberg, president of Generation Opportunity, an advocacy organization for young adults. "If they don't have a job, they can't even think about getting a car loan."

Take Vincent Nitopi of Alexandria, Va. Nitopi, 31, and his wife were hoping to buy a house last year, but the only mortgage they could secure carried too high an interest rate.

Though the couple want to own a home one day, they've postponed that goal for now. Nitopi is in the military, but he's concerned he could be the victim of a downsizing. So he now prefers to put any extra funds they have toward building a financial cushion.

"Picking up a couple of hundred thousand dollars in debt has put us off," he said about the idea of taking on a mortgage. "Renting is just fine."

Related: Americans still aren't saving enough

Brian Hackett, on the other hand, thought he'd be a homeowner by now. Instead, the 25-year-old is living with his parents and looking for full-time work after being let go recently from a part-time job.

Hackett graduated from The College of New Jersey magna cum laude in 2010. A thorough planner, he opted not to room at college in his last two years and to forgo graduate school to keep his student loan burden down. He hoped to launch a career in public policy or government as soon as he graduated so he could save for a down payment.

The lousy job market thwarted those plans. Now, he's not sure he'll be a homeowner by the time he turns 30.

"At this point, I don't think that will be possible," said Hackett, who applies for 10 jobs a week and was recently told he was overqualified. "I'm three years behind."

Young adults are pulling back on credit-card debt for similar reasons, said Amy Traub, a senior policy analyst at Demos, a public policy research organization. It found that Americans age 25 to 34 cut their credit card debt in half between 2008 and 2012.

All around them, young adults are seeing signs of financial distress -- job insecurity, foreclosures, high college costs. That's making them think twice about applying for loans, she said.

"Young people are being cautious in this difficult economic time," Traub said. "They are reluctant to take on debt." ![]()

First Published: February 27, 2013: 6:15 AM ET

3 basic steps to creating a retirement plan

NEW YORK (Money Magazine)

You, sir, need a plan.

A recent survey shows that people who've prepared a personal financial plan are more likely to feel as if they're on track to meet financial goals, like saving for retirement. That makes perfect sense, since it's hard to know whether you're on course if you haven't mapped one out.

Similarly, stats from the Employee Benefit Research Institute's Retirement Confidence Survey demonstrate that people who've made an attempt to calculate how much they'll need for retirement not only are more likely to put money away, they also aspire to higher savings targets.

But the payoff you get from planning extends beyond having a greater chance of achieving a secure and comfortable retirement down the road. Research also confirms that people who take control of their finances tend to be happier about their lives than those who don't. In effect, you get to reap at least some of the reward of planning and saving for retirement before you actually retire.

So, how can you create a retirement plan that can help you simultaneously feel better about your life today and improve your retirement prospects down the road? Here's a three-step guide:

1. Take stock of where you stand now: Start by pulling together the current balances of any money you have tucked away for retirement in all types of accounts -- 401(k)s, IRAs, other company savings plans, even savings earmarked for retirement that are held in taxable accounts.

After you've added up all the balances, estimate the percentage of your total savings you have in each of these three broad asset categories: stocks (including stock mutual funds), bonds (and bond mutual funds) and cash equivalents (money-market funds, money-market accounts, CDs, etc.)

Related: Americans still aren't saving enough

Then calculate the percentage of your gross annual income that you save in a 401(k) or other workplace plans (including any company matching funds) and note the dollar amount that you stash in investments outside your workplace plan.

2. Plug this information into a good retirement calculator. By "good," I mean a calculator that employes Monte Carlo-type simulations to allow for the variability in investment returns.

Among the free online calculators that do this are our Retirement Planner tool, T. Rowe Price's Retirement Income Calculator and Fidelity's Retirement Quick Check.

In addition to the savings and investment information I mentioned above, you'll also want to include an estimate of the age you intend to retire, your projected Social Security benefit and the percentage of your pre-retirement salary you'll need to maintain an acceptable standard of living in retirement.

Clearly, the younger you are, the "squishier" these estimates are likely to be. Just do your best and be reasonable.

If you're 40 and just beginning to save, then it would probably be unrealistic to expect to retire anytime before your mid-to-late '60s, and even that may be ambitious.

As for the percentage of pre-retirement income you'll require, anywhere between 70% to 90% is a credible estimate. You can get your projected Social Security benefit by going to Social Security's Retirement Estimator.

Once you've loaded all this information into the calculator, you'll get an estimate of the probability you'll be able to retire at the age you indicated with the income you specified. If you haven't been saving and investing regularly for retirement, your chances are probably going to be uncomfortably low -- maybe even well below 50%.

But don't panic. Your goal at this point is to improve your prospects as much as possible in the time you have left. The way to do that is to rerun the analysis with different assumptions to see which changes, alone and in combination with others, improve your outlook the most.

Related: Make your money last all through retirement

What you'll likely find is that you'll get the biggest boost by saving more and postponing retirement a few years. Investing more aggressively isn't likely to help as much, and could backfire.

Even though investing better isn't likely to improve your outlook as much as saving more or working a few more years, you don't want to squander your savings on a haphazard investment strategy or foolish investments.

So I recommend you settle on an asset allocation, or stocks-bonds mix, that's appropriate for your age and, aside from occasional rebalancing, leave it alone, except to shift more toward bonds as you get closer to retirement. Creating as much of that portfolio as possible with index funds will hold costs down and increase your potential return. If you're not confident about your ability to build a portfolio on your own, you can invest in a target-date retirement fund or use one as a guide for creating your own portfolio.

3. Follow through -- and periodically reassess. All this effort will be for naught, however, if you don't actually put the plan into place and, most importantly, save as much as you can.

You'll get the biggest bang for your savings buck by contributing to tax-advantaged plans like a 401(k) or IRA. If the 401(k) offers matching funds, be sure to contribute at least enough to get the full match.

Once you've exhausted your tax-advantaged options, you can move on to tax-efficient investments, such as index funds, ETFs or tax-managed funds, in taxable accounts.

Related: Social Security's role in your retirement portfolio

Retirement planning isn't something you do once and then forget about it. You'll need to periodically assess your progress and make adjustments to stay on track. So go through the process I've outlined every couple of years, stepping up the frequency to annually as your career winds down.

When you're within ten or so years of your anticipated retirement date, you could very well find that, despite your best efforts, you haven't accumulated enough resources to allow you to retire on schedule and lead the lifestyle you'd like. At that point, you can weigh options such as working longer, taking a part-time gig in retirement, scaling back your post-career lifestyle or looking for ways to stretch your resources by, say, taking out a reverse mortgage or relocating to an area with lower living costs.

Ultimately, no plan can guarantee you'll be able to achieve the retirement you envision. But I can assure you that your chances of retiring in comfort will be much, much lower if you don't have a plan at all. ![]()

First Published: February 27, 2013: 6:20 AM ET

Pimps hit social networks to recruit underage sex workers

NEW YORK (CNNMoney)

"I was just, 'oh, he's cute, I'll accept him,'" a 22-year-old called "Nina" recalls.

She was 18 at the time, and didn't imagine that clicking "accept" would start her on a path to four years of prostitution across the country. "Nina" is a pseudonym; CNNMoney agreed to change the names of the victims in this article to protect their privacy.

Upper middle-class and college-bound, Nina had her plans derailed in her senior year of high school after her mother was sentenced to two years in prison for financial crimes. Lonely and looking online for male attention, she started messaging back and forth with a man who said he was falling for her. They talked about trips they'd take together as a couple, and about marriage, maybe kids.

"He sold me the biggest dream in the world," she says. "I thought he really did like me and we were going to live this fairy-tale life together."

They exchanged online messages for about a month. That September, while Nina's friends went off to college, she traveled the two and half hours from home to meet her Facebook beau in person.

The fairy tale ended fast. Almost immediately after she arrived in Seattle, he dropped her off on a street where prostitutes troll for customers and told her she was going to "catch dates."

Many would have run, but Nina says her deteriorating family life left her with a sense of desperation. She was smitten, and willing to do anything for the man she thought loved her. So she stayed.

Keeping the attention of her "boyfriend" required selling herself for sex, Nina learned. He was a pimp -- and she was one of a growing number of women recruited on social networks for sex trafficking.

There are no hard statistics on the scope of the problem. Law enforcement officials don't track how sex workers are recruited into the field, and unless the victims are underage, prostitution is typically a low-priority crime.

But recent prosecutions in California, Virginia and Washington, along with interviews CNNMoney conducted with victims and those investigating these crimes, illustrate how social networks are helping traffickers lure in victims like Nina.

"Pimps are professional exploiters," says Andrea Powell, executive director of Fair Girls, an organization that helps victims of sex trafficking. "Often they're just spamming a whole bunch of girls with messages like, 'Hey, you look cute. I could be your boyfriend.'"

That's one way Justin Strom -- aka "J-Dirt" -- recruited the high-school girls he and his followers trafficked in Alexandria, Va., an affluent suburb on the outskirts of Washington, D.C. For six years, the members of Strom's "Underground Gangster Crips" gang operated a prostitution ring that ensnared at least eight 16- and 17-year olds, according to court documents.

See the court records: Justin Strom's Facebook messages

The girls were rented out to five to 10 customers each on a typical night. The going rate was around $30 for 15 minutes of sex.

Social networks were among Strom's preferred hunting grounds.

The group "searched Facebook for attractive young girls, and sent them messages telling them that they were pretty and asking if they would like to make some money," one witness told a Federal Bureau of Investigation agent investigating the case. The court records include a trail of those messages.

Strom had a collection of fake Facebook accounts. On one of them, for "Rain Smith" investigators found more than 800 messages sent out to potential targets.

If a girl expressed interest, a gang member would arrange to meet up. At that point, participation stopped being voluntary.

One 17-year-old solicited on Facebook allowed Strom to pick her up in his car at her home, but when he spelled out what he expected, she told Strom she wanted out. In response, he "slammed her head against the window of the vehicle," forced her to ingest cocaine, and slashed her arm with a knife, according to court documents.

That night, he took her to an apartment complex and rented her out to 14 men. The encounter netted Strom $1,000. It left the victim with a collection of physical scars.

"He's a con artist, a monster and a manipulator," another victim testified at his sentencing. "I was brainwashed into believing that having sex with men for money was normal, an everyday thing."

An FBI operation shut Strom's gang down last year, and in September he was sentenced to 40 years in prison. Four of his associates were also convicted.

But FBI cybercrimes supervisor Jack Bennett says Strom's tactics are becoming more common. Part of the problem, he says, is that minors will accept friend requests from strangers just to appear to be popular. Photos, personal information, and friend lists are then out in the open.

Pimps "start looking for the cracks where they can fill the holes, whether it be a father figure or a boyfriend," Bennett says.

Some are even more direct.

"Lisa," a 21-year-old who was a sex worker on and off for three years before escaping in mid-2012, gets daily messages on social networking sites from traffickers trying to reel her back in. Many don't even hide their intentions.

"If it's a 'P' beside their name, that stands for pimp," Lisa says. On any given day, she gets a steady stream of messages from unfamiliar men whose last names are just "P."

'Old tricks with new tools'

Powell, the advocate who runs Fair Girls, says she's seen girls recruited from almost every social network that exists. Facebook and Tagged are two of the most common, she says, but even more limited sites like Twitter and Instagram get used for solicitation. The FBI's case against Strom cites DateHookup and MySpace, in addition to Facebook, as sites his gang targeted.

In a recent Seattle case involving multiple juveniles, Facebook was used to recruit one of the victims. The two defendants were charged in Pierce County, Wash., in November.

"What you're really seeing here with Facebook, and other social networking sites, is old tricks with new tools," says Pierce County prosecutor Mark Lindquist.

The Polaris Project, which runs a sex-trafficking help hotline, works with tech companies to educate them on how their technology is being used to facilitate trafficking, and how they can help stop it.

"They're most interested in understanding exactly how the criminal networks are operating, and they want to know the modus operandi of the traffickers," says Bradley Myles, executive director of Polaris.

Facebook (FB) reacts swiftly to reports of illicit activity and quickly takes down questionable content when it's flagged, according to Myles and other advocates.

The company says it takes human trafficking very seriously.

"While this behavior is not common on Facebook, we have implemented robust protections to identify and counter this activity," a company representative told CNNMoney in a written statement. "We have zero tolerance for this material and are extremely aggressive in preventing and removing exploitative content. We've built complex technical systems that either block the creation of this content, or flag it for review by our team of investigations professionals."

But algorithms can't catch everything, and pimps are skillful social engineers.

During down time, Nina's pimp browsed through her Facebook friends, sending friendship requests using her profile and messaging women he thought "looked the part."

Strom used similar tactics, relying on women he controlled to reach out to new prospects. He also sent hundreds of messages himself to teenagers, with pitches like: "I work with girls that dance nude do partys dates one on ones and more does any of that interest you."

Calvin Winbush, who calls himself "Good Game," ran a prostitution business out of Ohio. He was sentenced in August to 14 years in prison for trafficking minors across state lines for prostitution. Winbush described himself as an "international player" on his Facebook page, and recruited heavily with messages like: "Call me soon as u get this love so we can chop it up and get better acquainted..."

That kind of approach works more often than parents would like to believe.

"There's no high school that's immune to this," Ken Cuccinelli, Virginia attorney general, said in a press conference unveiling the charges against Strom. "It demands increased vigilance by both parents and law enforcement into the activities that are occurring across those social media lines."

The FBI, which is often on the front lines of investigating these cases, has a tip sheet on its website to help parents protect their children on social networks.

The agency recommends that parents monitor their kids' online profiles and postings -- a controversial step in many households, but one the agency thinks is essential. It also recommends that parents educate their kids about how broadly the messages and photos they post online can spread. Teenagers don't always realize that they can't "take back" texts and images.

"I've talked to parents who say, 'Hey listen, my son has to set up my computer 'cause I just don't know,'" says the FBI's Bennett. "That's not an excuse anymore. You've got to know, because it's your child's life and their well-being depends on this."

Breaking free

Nina describes being raped, beaten with a pistol, and, once, locked in a closet for 24 hours. Beyond the physical threats, shame kept her from running away.

"I didn't want to tell my parents, 'Ya know, this is what I'm doing,'" she says. "How am I going to explain that to my father? That wasn't an option for me at all."

Nina bounced through a series of different pimps, eventually ending up "working" for a trafficker who took away her ID and forced her to dance -- and more -- at strip clubs and in hotel rooms.

A massive raid by local police and the FBI shut down his operation about a year ago. Without that, Nina says she could still be working for him today. Advocates at Fair Girls are helping her rebuild her life. She's planning to begin college in the fall.

Both Nina and Lisa still maintain accounts on the social networks on which they were recruited, mainly to keep in touch with friends and family. Both receive daily messages from pimps.

They no longer respond.

"I want to get my life together," says Lisa, who is working to earn her GED. "If I start school, I probably won't have a Facebook page." ![]()

First Published: February 27, 2013: 7:17 AM ET

Jawbone: A partnership for unique products

Written By limadu on Selasa, 26 Februari 2013 | 21.29

Jawbone's Yves Behar, left, and Hosain Rahman

(Fortune)

"Hosain and I are two people who have been at Jawbone longer than practically anyone," Behar says. "Over 10 years we've developed an understanding, a shared philosophy that allows us to improve on our original goal -- adapting products for wearability." Rahman adds that for collaboration to work you must "put your life force into each project," which is to say: Be dedicated.

"When we started with headsets," Behar continues, "it was the hardest thing I've ever worked on. I've designed shoes, and you hear from the customer immediately if something doesn't fit. It's like that, but with sound. We spent years refining, failing, and succeeding, and now, finally, we're building on that knowledge. It's an ongoing process."

--Our Face to Face series examines successful business partnerships that offer lessons on collaboration and compromise.

This story is from the February 4, 2013 issue of Fortune. ![]()

First Published: February 26, 2013: 7:50 AM ET

Budget cuts: I'm losing my job next week

On March 9, Raymond Wyrick will lose his job as a mechanic refurbishing Humvees for the U.S. Army, if federal budget cuts kick in this Friday.

WASHINGTON (CNNMoney)

As Washington continues to wrangle over the cuts, Wyrick is one of 414 workers in Texarkana, Texas, who are preparing to join the unemployment rolls.

The Red River Army Depot, where Wyrick and his fellow workers refurbish military vehicles, stands to lose $600 million from its budget starting this Friday.

A Humvee mechanic, 38-year-old Wyrick has worked at the depot for five years and makes about $47,000 a year. He worries about what it will mean for his family of three.

"I don't know how we're going to make it," said Wyrick, whose last day at work is March 9.

The depot is cutting 10% of its workforce of 4,000. The layoffs started on Feb 23. The rest of the employees will face furloughs, according to Cebron O'Bier, president of the union at the depot.

"Right now, the morale is way down. People are going into a panic, they don't know what they're going to do," Wyrick said.

He is on the front line of the forced spending cuts that will slash budgets of federal agencies. Most of the 2.1 million federal workers face furloughs.

CNN.com: Spending cut countdown

Roughly half of the cuts will come at the Pentagon -- most of its 800,000 civilian workers would start furloughs in late April.

Employees like Wyrick are among some 46,000 temporary or contract workers losing jobs nationwide, the Pentagon has said. And, like Wyrick, many of them work full-time with benefits, even though they're employed for a specific period of time and purpose. Since their jobs depend upon contracts being renewed, they're particularly vulnerable to budget cuts.

Pentagon spokeswoman Army Lt. Col. Elizabeth Robbins said agency officials regret the layoffs and are "deeply concerned about the effects of these actions on our military readiness, as well as the immediate effects on our civilian colleagues and their families."

Related: 7 budget cuts you'll really feel

The Red River Army Depot workers are puzzled over the cutbacks, because they say they save money for the Pentagon. By refurbishing older, war-torn vehicles they lead to fewer purchases of new cars and trucks for the Army.

"We overhaul various military vehicles, take them down to the smallest possible piece of material, refurbish them, and put them back together as good as a brand new vehicle," union president O'Bier said.

The depot is also a major economic force for the West Arkansas and East Texas area, where it is located. Employment gains at the depot helped the area rebound faster than other metropolitan areas in the region, said Kathy Deck, an economist and director of the Center for Business and Economic Research at University of Arkansas.

The unemployment rate in Texarkana was 5.7% in December, compared with the 7.8% unemployment rate nationwide, according to Bureau of Labor Statistics. Cuts at the Red River Army Depot will resonate throughout area restaurants, shops and other businesses, Deck said.

The loss will upend Wyrick's life. He's unsure if unemployment benefits will be enough to cover his home mortgage and insurance payments, not to mention basics like food and gas.

Wyrick found out that a local tire manufacturer he was hoping to ask for a job isn't hiring either. The company is cutting back because it's losing orders from the depot.

Now, Wyrick says he's looking into federal contractors who hire mechanics to work overseas.

"I grew up here and and have lived here my whole life, so a move overseas would be pretty drastic, you know, pretty drastic," Wyrick said. ![]()

First Published: February 26, 2013: 8:14 AM ET

Home prices shoot higher

NEW YORK (CNNMoney)

The report from S&P Case-Shiller covered home prices across 20 major housing markets nationwide in the final three months of the year. It comes ahead of a government report due later Tuesday which is expected to show a continued rise in new home sales.

The home price increase marks the third straight quarter of year-over-year gains in prices. Before the market began to turn around, there had been only two quarters over the previous five years that showed improved pricing. That short-term blip was caused by a temporary home buyer's tax credit that expired in 2010.

This time the improvement is driven by fundamental factors, including near record-low mortgage rates, a drop in the number of home foreclosures, a tight supply of homes available for sale, and an improvement in the overall economy, including a lower unemployment rate. The resulting rise in home prices is the biggest annual increase posted since the second quarter of 2006, near the height of the housing boom.

But the report suggests housing may not be able to continue to grow at this rate.

"These movements, combined with other housing data, suggest that while housing is on the upswing, some of the strongest numbers may have already been seen," said David M. Blitzer, chairman of the index committee at S&P Dow Jones Indices.

Related: Housing - how to play the rebound

Still, the rise in home prices can provide a lift for the economy as it increases household wealth and allows homeowners who had previously owed more than their homes were worth to refinance their mortgages, putting more money in their pockets.

Home builders are picking up the pace of construction in response to the recovery, as they filed for the most building permits in more than four years in January. Stocks of major home builders, including KB Home (KBH), D.R. Horton (DHI) and Toll Brothers (TOL) have been steadily rising in recent months on the improvement in the market. ![]()

First Published: February 26, 2013: 9:10 AM ET

Business saves $270K. The trick? No employees

Xan Hood, founder of clothing startup Buffalo Jackson, relies entirely on freelancers. It's part of a small business boom in the use of temp workers.

NEW YORK (CNNMoney)

He's got two artists, two accountants, a photographer, a web consultant and a customer service representative -- and they are all freelancers.

If they were on Hood's payroll, their combined salary would probably have cost him $300,000 last year. Instead, he paid closer to $30,000.

His cash-strapped startup, Buffalo Jackson in Charlotte, N.C., doesn't need them working full-time. At this point, there just isn't enough work to do.

"We need to be efficient and resourceful with the little we have," Hood said.

Related: Pot dealers get slammed by taxes

Relying on freelancers saves him time and money in all sorts of ways. There's less government paperwork. He doesn't have to pay the federal payroll tax that funds Social Security and Medicare, 7.7% of workers' wages.

And there are no worries about North Carolina's unemployment insurance rate, which ranges between 1.2% and 6.8% of employee salaries. Even with just a few employees, these taxes can quickly add up to thousands of dollars a year.

"That's how we've kept our company lean and mean," Hood said. "I'm watching every dollar coming in or out of the company."

Buffalo Jackson, which designs clothes and contracts with manufacturers to produce them, is expanding quickly and might make $1 million in revenue this year. But Hood, who pays himself a small salary, still says his enterprise is in "survival mode."

Buffalo Jackson is part of the boom in temporary work. After all, why take on the cost and risk of hiring an employee if you can get one without strings attached?

Some business owners are heading to online platforms, like Buffalo Jackson did with Elance, where they find freelancers who bid on jobs. Others avoid hiring an employee directly by paying a staffing agency to do it for them.

Both options are growing in popularity. On Elance alone, more than 1.6 million U.S. jobs have been posted since mid-2011. Labor Department statistics show that the number of workers provided by temp agencies has more than doubled since 1990.

Employees end up with temporary or unstable jobs, a classification known as "contingent workers" that makes up about a third of the workforce, according to the Government Accountability Office.

But it's not necessarily a raw deal.

Related: India's luxury chocolate craving

Melissa Simpson turned to Elance after a car crash left her unable to lift heavy loads at her retail clothing job. The mother of five in Colorado Springs, Colo., searched for administrative office work she could do from home. Her first gig was with Buffalo Jackson, where she now takes customer orders and answers phone calls.

"I enjoy having time with my family and a flexible schedule," she said. "It's been a lifesaver."

Lately, though, Simpson has entered something of a gray area. She's been working 30-hour weeks, sometimes more during the holidays.

Hood said he's now faced with a decision: keep Simpson as a freelancer or move her onto his payroll. He's not sure he's ready for the additional duties of a manager -- or whether it's even necessary.

"The next stage in our company is taking ownership of responsibilities of a traditional workplace," he said. "But I'm not at the point where I want people to be depending on us as a source of hours every month."

Simpson, however, welcomes the idea.

"It would give me a sense of stability," Simpson said. "I would feel so much more a part of his company." ![]()

First Published: February 26, 2013: 6:12 AM ET

Workers over 50 are the new 'unemployables'

Mary Clair Matthews, Tony Kash and Jill Cummings are struggling to find jobs. Click the photo to read their stories.

NEW YORK (CNNMoney)

On one hand, they're too young to retire. They may also be too old to get re-hired.

Call them the "new unemployables," say researchers at Boston College.

Older workers were less likely to lose their jobs during the recession, but those who were laid off are facing far tougher conditions than their younger colleagues. Workers in their fifties are about 20% less likely than workers ages 25 to 34 to become re-employed, according to an Urban Institute study published last year.

"Once you leave the job market, trying to get back in it is a monster," said Mary Clair Matthews, 58, who has teetered between bouts of unemployment and short temp jobs for the last five years. She applies for jobs every week, but most of the time, her applications hit a brick wall.

Employers rarely get back to her, and when they do she's often told she is "overqualified" for the position. Sometimes she wonders: Is that just a euphemism for too old?

Her resume shows she has more than 30 years of experience working as a teacher, librarian, academic administrator and fundraiser for non-profits.

"I've thought about taking 10 years off my resume," she said. "It's not like we're senile. The average age of Congress is something like 57. Joe Biden is 70. Ronald Reagan was in his 70s when he was president. So what's the problem?"

That's a question on the minds of many older workers.

Take Jill Cummings, 55, who has thought about dying her gray hair to improve her chances of landing a job. Then there's Tony Kash, 50, who wonders why his 30 years experience in manufacturing and management is no match for 25-year-olds fresh out of college with business degrees.

Nearly two-thirds of unemployed workers age 55 and older say they have been actively searching for a job for more than one year, compared to just one-third of younger workers, a recent survey by the Heldrich Center for Workforce Development at Rutgers University found.

Related story: Millions expect to outlive retirement savings

Older workers also have the longest bouts of unemployment. The average duration of unemployment for workers ages 55 to 64 was 11 months as recently as January, according to the Labor Department. That's three months longer than the average for 25- to 36-year-olds.

Given these circumstances, many workers can't help but think age discrimination is a factor. AARP's Public Policy Institute surveyed unemployed baby boomers in 2010 and 2011. While 71% blamed their unemployment on the bad economy, almost half also said they believed age discrimination was also at play.

About 23,000 age discrimination complaints were filed with the Equal Employment Opportunity Commission in fiscal 2012, 20% more than in 2007.

Proving discrimination is next to impossible, though, unless it's blatant.

"It's very difficult to prove hiring discrimination, because unless somebody says, 'you're too old for this job,' you don't know why you weren't hired," said Michael Harper, a law professor at Boston University.

Plus, employers may have rational qualifications that are inadvertently weeding out older candidates. Recent education and technological skills are two areas where older workers are more likely to come up short compared to the younger competition.

"When there's a large supply of unemployed workers, employers can afford to be choosier, and they're opting for workers they think are less expensive or more recently trained," said Sara Rix, senior strategic policy advisor for AARP's Public Policy Institute.

That's a hard reality for older job-seekers.

"When you're at 55 or 60, you've had a lifetime of work. You've played by the rules, and the rug has been pulled out from you," Rix added. ![]()

First Published: February 26, 2013: 6:18 AM ET

Community college grads out-earn bachelor's degree holders

Nearly 30% of Americans with associate's degrees now make more than those with bachelor's degrees, according to Georgetown University's Center on Education and the Workforce

NEW YORK (CNNMoney)

That's 15% higher than the average starting salary for graduates -- not only from community colleges, but for bachelor's degree holders from four-year universities.

"I have a buddy who got a four-year bachelor's degree in accounting who's making $10 an hour," Omer says. "I'm making two and a-half times more than he is."

Omer, who is 24, is one of many newly minted graduates of community colleges defying history and stereotypes by proving that a bachelor's degree is not, as widely believed, the only ticket to a middle-class income.

Nearly 30% of Americans with associate's degrees now make more than those with bachelor's degrees, according to Georgetown University's Center on Education and the Workforce. In fact, other recent research in several states shows that, on average, community college graduates right out of school make more than graduates of four-year universities.

The average wage for graduates of community colleges in Tennessee, for instance, is $38,948 -- more than $1,300 higher than the average salaries for graduates of the state's four-year institutions.

Related: Colleges find a new way to get grads hired

In Virginia, recent graduates of occupational and technical degree programs at its community colleges make an average of $40,000. That's almost $2,500 more than recent bachelor's degree recipients.

"There is that perception that the bachelor's degree is the default, and, quite frankly, before we started this work showing the value of a technical associate's degree, I would have said that, too," says Mark Schneider, vice president of the American Institutes for Research, which helped collect the earning numbers for some states.

And while by mid-career, many bachelor's degree recipients have caught up in earnings to community college grads, "the other factor that has to be taken into account is that getting a four-year degree can be much more expensive than getting a two-year degree," Schneider says.

A two-year community college degree, at present full rates, costs about $6,262, according to the College Board. A bachelor's degree from a four-year, private residential university goes for $158,072.

The increase in wages for community college grads is being driven by a high demand for people with so-called "middle-skills" that often require no more than an associate's degree, such as lab technicians, teachers in early childhood programs, computer engineers, draftsmen, radiation therapists, paralegals, and machinists.

With a two-year community college degree, air traffic controllers can make $113,547, radiation therapists $76,627, dental hygienists $70,408, nuclear medicine technologists $69,638, nuclear technicians $68,037, registered nurses $65,853, and fashion designers $63,170, CareerBuilder.com reported in January.

Related: How does your community college stack up?

"You come out with skills that people want immediately and not just theory," Omer says.

The Georgetown center estimates that 29 million jobs paying middle class wages today require only an associate's, and not a bachelor's, degree.

"I would not suggest anyone look down their nose at the associate's degree," says Jeff Strohl, director of research at the Georgetown center.

"People see those programs as tracking into something that's dead end," Strohl says. "It's very clear that that perception does not hold up."

The bad news is that not enough associate's degree holders are being produced.

Only 10% of American workers have the sub-baccalaureate degrees needed for middle-skills jobs, compared with 24% of Canadians and 19% of Japanese, the Organization for Economic Cooperation and Development reports.

Over the last 20 years, the number of graduates with associate's degrees in the United States has increased by barely 3%. And while the Obama administration has pushed community colleges to increase their numbers, enrollment at these schools fell 3.1% this year, the National Student Clearinghouse Research Center reports. Graduation rates also remain abysmally low.

Related: Community colleges: How to avoid 'dropout factories'

Meanwhile, many people with bachelor's degrees are working in fields other than the ones in which they majored, according to a new report by the Center for College Affordability and Productivity.

"We have a lot of bartenders and taxi drivers with bachelor's degrees," says Christopher Denhart, one of the report's coauthors.

Still, the salary advantage for associate's degree holders narrows over time, as bachelor's degree recipients eventually catch up, says Schneider.

Although these figures vary widely by profession, associate's degree recipients, on average, end up making about $500,000 more over their careers than people with only high school diplomas, but $500,000 less than people with bachelor's degrees, the Georgetown center calculates.

As for Omer, he's already working toward a bachelor's degree.

"Down the road a little further, I may want to become a director or a manager," he says. "A bachelor's degree will get me to that point."

This story was produced by The Hechinger Report, a nonprofit, nonpartisan education-news outlet based at Teachers College, Columbia University. It's one of a series of reports about workforce development and higher education. ![]()

First Published: February 26, 2013: 6:23 AM ET

Adoption tax credit for same-sex couples

Written By limadu on Senin, 25 Februari 2013 | 21.29

Sharon McGowan, left, and her wife Emily expect to receive an adoption tax credit of more than $2,000 after Sharon legally adopted their daughter.

NEW YORK (CNNMoney)

The adoption tax credit grants qualifying taxpayers up to $12,650 per child for qualifying expenses. Opposite-sex married couples can claim it when they adopt a child together, but when one spouse adopts the child of his or her spouse, they don't qualify.

But under the Defense of Marriage Act, same-sex couples aren't recognized as married in the eyes of the federal government and therefore can qualify for the credit when adopting a partner's child, known as a second parent adoption.

Qualifying expenses include legal fees and court costs, which typically run from $1,500 to $2,500, along with a fee of around $1,200 for a home study -- a screening process that entails home checks and interviews. Altogether, second parent adoptions can cost up to $5,000, said Gideon Alper, a Florida adoption attorney who regularly counsels same-sex couples.

Related: Businesses band together to support gay marriage

And since same-sex couples are hurt by the tax code in many other ways -- they can't file jointly and owe estate and gift tax that opposite-sex couples don't, for example -- it's an important credit to know about.

"Same-sex couples face a big disadvantage tax-wise through the rest of the system by not being married [at a federal level], so this is like a saving grace that lets them save a little money," said Alper.

Sharon McGowan, from Takoma Park, Md., went through a second parent adoption late last year, after her wife, Emily, gave birth to their daughter, Sadie.

While Sharon and Emily are married at a state level, the federal government doesn't recognize their union and many other states don't either. So to guarantee Sharon has full parental rights wherever she goes, the couple spent over $2,000 in legal fees and other costs to adopt Sadie.

"I never wanted to have the risk of someone refusing to let me see Sadie in hospital or make medical decisions for Sadie," said Sharon. "I wanted to make sure my relationship with Sadie was airtight."

Related: 'What legalizing gay marriage means for our money'

The couple made sure to complete the adoption before the end of the year so they could qualify for the credit -- which was originally scheduled to expire on Dec. 31, but ended up being permanently extended under the fiscal cliff deal. They're hoping the tax credit this year will cover the adoption expenses they incurred.

The credit is nonrefundable, so it will offset some of their overall tax bill. And the extra money they don't have to put toward taxes this year will go toward Sadie's daycare.

The couple says they are lucky their state even allows second parent adoptions, since some don't. But they don't think the credit should be considered a "benefit," because they wouldn't have had to go through the second parent adoption process and incur those costs at all if their marriage had been federally recognized in the first place.

Along with second parent adoptions, the adoption credit is also available for joint adoptions where neither parent is the birth parent -- and both same-sex and opposite-sex couples can claim the credit in this case. Since same-sex couples can't file their taxes jointly, however, only one partner can claim the credit, or they must each claim a portion of it.

Related: Financial benefits at stake in gay marriage case

If DOMA is overturned, which is a possibility since the Supreme Court is expected to weigh in on the constitutionality of the law for the first time this year, same-sex couples who are married at the state level would also be considered married for federal tax purposes.

This means they would be able to file jointly, but they would no longer receive a credit for a second parent adoption.

It's up in the air whether couples in civil unions or domestic partnerships would still be allowed to take the credit, however. It will depend on whether the federal government's definition of marriage would encompass those relationships, said Patricia Cain, a law professor at Santa Clara University in California.

For Sharon and Emily, the inequities same-sex couples face under DOMA far outweigh the couple thousand dollars they will get that a married couple won't.

"We would be very, very happy to give up the adoption credit to have our marriage recognized," said Sharon. ![]()

First Published: February 25, 2013: 6:28 AM ET

U.K. vows to stick with austerity

Finance minister George Osborne says loss of AAA rating means cuts must continue

LONDON (CNNMoney)

Moody's cut its rating to Aa1 late Friday, saying growth would remain weak into the second half of the decade, making it harder for the government to deliver on its debt-cutting targets and undermining the ability of the U.K. to withstand future shocks.

"Britain has to stick to the course, and we will," finance minister George Osborne wrote in The Sun newspaper on Sunday.

"For we've had a stark reminder this weekend of the single most important truth about our economy -- Britain has a debt problem, built up over many years, and we have got to deal with it."

Moody's said it expected the U.K.'s debt to peak at 96% of gross domestic product in 2016, up from around 90% today.

A downgrade had been talked about for months, against the backdrop of a deepening recession in Europe and Osborne's acknowledgment late last year that borrowing would remain higher for longer than expected.

But it still served as a reminder of the poor growth prospects for the world's sixth biggest economy, and added fuel to speculation that the Bank of England will have to compensate for the lack of growth -- and the government's hawkish stance on fiscal policy -- by easing monetary policy still further.

Related: Eurozone economy to shrink again in 2013

Investors took the downgrade as another reason to sell sterling, extending a slide which began at the start of the year. The currency dropped 0.1% to its lowest level since July 2010 against the dollar, and 0.6% against the euro to levels last seen in October 2011.

Yields on 10-year government bonds have been rising for about six months and they ticked higher again Monday to 2.1%, still low by historical standards.

The Bank of England has signalled recently that it may be prepared to tolerate above-target inflation for longer, while growth remains weak. Three members of its monetary policy committee -- including outgoing Governor Mervyn King -- voted at its last meeting to expand its bond-buying program.

They were outvoted, but the previous time the committee split 6-3, the bank followed up at its next meeting with more monetary stimulus.

Related: Europe: No retreat from austerity

Osborne said Germany and Canada -- the only big economies still with AAA-ratings from all three major agencies -- had taken advantage of better times before the financial crisis to reduce deficits and make their economies more competitive, while Britain had built up the biggest structural deficit of all.

"Now we have no choice but to continue the hard work of putting our house in order," he wrote. ![]()

First Published: February 25, 2013: 7:23 AM ET

Barnes & Noble chairman wants to buyout company's stores

NEW YORK (CNNMoney)

Riggio, who disclosed his plans in a filing with the Securities and Exchange Commission on Monday, did not disclose a price for his planned purchase. Shares of the nation's largest book retailer soared 2.4% in premarket trading on the news.

Riggio is already the largest shareholder of Barnes & Noble (BKS, Fortune 500), with nearly a 30% stake in the company.

The company had already been considering spinning off the Nook business as a separate company. Last April, it announced a deal with Microsoft (MSFT, Fortune 500) in which the software firm bought a then 17.6% stake in Nook and publisher Pearson (PSO) bought a 5% stake in Nook in December. Those deals both value the overall Nook business at more than $1.7 billion, even though Barnes & Noble stock is worth just less than $800 million.

Related: Top 3 e-book picks

In early January, the company reported a weak Christmas season, with sales at its retail stores falling 11% from a year earlier and sales at its Nook unit falling 12.6% to just $300 million. Earlier this month, it warned of rising losses and disappointing sales for its Nook unit during its just complete fiscal year, results of which are due to be reported Thursday.

Barnes and Noble and other traditional book retailers have struggled with competition from Amazon.com (AMZN, Fortune 500), which has its own Kindle e-book. Rival brick-and-mortar store chain Borders filed for bankruptcy two years ago and went out of business in July 2011.

![]()

First Published: February 25, 2013: 8:38 AM ET

Marijuana dealers get slammed by taxes

Denver Relief, one of the largest marijuana dispensaries in Colorado, has an effective tax rate of around 50%, according to co-owner Kayvan Khalatbari.

NEW YORK (CNNMoney)

The hefty levy is the result of a 1982 provision to the tax code, known as 280E, that stemmed from a successful attempt by a convicted drug trafficker to claim his yacht, weapons and bribes as businesses expenses, according to 280E Reform, a group working to overturn the statute.

Enacted in the wake of that PR debacle, the rule bars those selling illegal substances from deducting related expenses on their federal income taxes.

It may have been effective against cocaine dealers and smugglers of other hard drugs, but the law now means purveyors of medical marijuana in the 18 states that have legalized the drug can't can't take typical things like rent or payroll as a business expense. That's taking a heavy toll on this new field.

"I'd personally love to give my employees a raise," said Kayvan Khalatbari, co-owner of Denver Relief, a medical marijuana center in its namesake city. "But because of the industry we're in, that's not always possible."

Related: Newest government job - expert pothead

Khalatbari said Denver Relief does just over $1 million a year in sales, and that not being able to take some standard business deductions costs him tens of thousands of dollars annually. He estimates his effective federal tax rate is about 50%.

For Denver Relief -- one of the largest marijuana dispensaries in Colorado, with a full-time staff of 15 -- the burden isn't killing the business. But for others, it's been lethal.

Jim Marty, an accountant in Colorado specializing in medicinal marijuana tax law, said he has one client that didn't turn a profit in 2009, 2010 or 2011. In 2012, though, she was handed a $300,000 tax bill from the IRS for those three proceeding years.

Entrepreneurs whose businesses are legal under state laws are getting hammered by outdated federal tax rules.

"If you have a license from the state hanging on your wall, that doesn't fit the definition of trafficking," Marty said. "Yet the IRS is aggressively auditing this industry."

He said he often sees clients facing effective tax bills of 65% to 75%. That compares to 15% to 30% for businesses in general.

The Internal Revenue Service did not respond to a request for comment. In a letter to a congressman in 2011, the agency said it was merely enforcing the law, and that Congress needs to change the law if it does not want medicinal marijuana dealers caught up in the provision.

Several groups are working on just that, though it's unclear if the law will be changed anytime soon. The Obama administration has so far not expressed much interest in weighing in on the matter.

Until then, those in the industry will keep looking for crafty ways to minimize their tax bill, and pay the tax man when they can't.

"An emerging industry that can provide hundreds of thousands of jobs is being held back by these crazy tax rates," said Betty Aldworth, deputy director of the National Cannabis Industry Association. "We're like any other small businesses, that just happens to be illegal in some states." ![]()

First Published: February 25, 2013: 6:09 AM ET

Adoption tax credit for same-sex couples

Sharon McGowan, left, and her wife Emily expect to receive an adoption tax credit of more than $2,000 after Sharon legally adopted their daughter.

NEW YORK (CNNMoney)

The adoption tax credit grants qualifying taxpayers up to $12,650 per child for qualifying expenses. Opposite-sex married couples can claim it when they adopt a child together, but when one spouse adopts the child of his or her spouse, they don't qualify.

But under the Defense of Marriage Act, same-sex couples aren't recognized as married in the eyes of the federal government and therefore can qualify for the credit when adopting a partner's child, known as a second parent adoption.

Qualifying expenses include legal fees and court costs, which typically run from $1,500 to $2,500, along with a fee of around $1,200 for a home study -- a screening process that entails home checks and interviews. Altogether, second parent adoptions can cost up to $5,000, said Gideon Alper, a Florida adoption attorney who regularly counsels same-sex couples.

Related: Businesses band together to support gay marriage

And since same-sex couples are hurt by the tax code in many other ways -- they can't file jointly and owe estate and gift tax that opposite-sex couples don't, for example -- it's an important credit to know about.

"Same-sex couples face a big disadvantage tax-wise through the rest of the system by not being married [at a federal level], so this is like a saving grace that lets them save a little money," said Alper.

Sharon McGowan, from Takoma Park, Md., went through a second parent adoption late last year, after her wife, Emily, gave birth to their daughter, Sadie.

While Sharon and Emily are married at a state level, the federal government doesn't recognize their union and many other states don't either. So to guarantee Sharon has full parental rights wherever she goes, the couple spent over $2,000 in legal fees and other costs to adopt Sadie.

"I never wanted to have the risk of someone refusing to let me see Sadie in hospital or make medical decisions for Sadie," said Sharon. "I wanted to make sure my relationship with Sadie was airtight."

Related: 'What legalizing gay marriage means for our money'

The couple made sure to complete the adoption before the end of the year so they could qualify for the credit -- which was originally scheduled to expire on Dec. 31, but ended up being permanently extended under the fiscal cliff deal. They're hoping the tax credit this year will cover the adoption expenses they incurred.

The credit is nonrefundable, so it will offset some of their overall tax bill. And the extra money they don't have to put toward taxes this year will go toward Sadie's daycare.

The couple says they are lucky their state even allows second parent adoptions, since some don't. But they don't think the credit should be considered a "benefit," because they wouldn't have had to go through the second parent adoption process and incur those costs at all if their marriage had been federally recognized in the first place.

Along with second parent adoptions, the adoption credit is also available for joint adoptions where neither parent is the birth parent -- and both same-sex and opposite-sex couples can claim the credit in this case. Since same-sex couples can't file their taxes jointly, however, only one partner can claim the credit, or they must each claim a portion of it.

Related: Financial benefits at stake in gay marriage case

If DOMA is overturned, which is a possibility since the Supreme Court is expected to weigh in on the constitutionality of the law for the first time this year, same-sex couples who are married at the state level would also be considered married for federal tax purposes.

This means they would be able to file jointly, but they would no longer receive a credit for a second parent adoption.

It's up in the air whether couples in civil unions or domestic partnerships would still be allowed to take the credit, however. It will depend on whether the federal government's definition of marriage would encompass those relationships, said Patricia Cain, a law professor at Santa Clara University in California.

For Sharon and Emily, the inequities same-sex couples face under DOMA far outweigh the couple thousand dollars they will get that a married couple won't.

"We would be very, very happy to give up the adoption credit to have our marriage recognized," said Sharon. ![]()

First Published: February 25, 2013: 6:28 AM ET

U.K. vows to stick with austerity

LONDON (CNNMoney)

Moody's cut its rating to Aa1 late Friday, saying growth would remain weak into the second half of the decade, making it harder for the government to deliver on its debt-cutting targets and undermining the ability of the U.K. to withstand future shocks.

"Britain has to stick to the course, and we will," finance minister George Osborne wrote in The Sun newspaper on Sunday.

"For we've had a stark reminder this weekend of the single most important truth about our economy -- Britain has a debt problem, built up over many years, and we have got to deal with it."

Moody's said it expected the U.K.'s debt to peak at 96% of gross domestic product in 2016, up from around 90% today.

A downgrade had been talked about for months, against the backdrop of a deepening recession in Europe and Osborne's acknowledgment late last year that borrowing would remain higher for longer than expected.

But it still served as a reminder of the poor growth prospects for the world's sixth biggest economy, and added fuel to speculation that the Bank of England will have to compensate for the lack of growth -- and the government's hawkish stance on fiscal policy -- by easing monetary policy still further.

Related: Eurozone economy to shrink again in 2013

Investors took the downgrade as another reason to sell sterling, extending a slide which began at the start of the year. The currency dropped 0.1% to its lowest level since July 2010 against the dollar, and 0.6% against the euro to levels last seen in October 2011.

Yields on 10-year government bonds have been rising for about six months and they ticked higher again Monday to 2.1%, still low by historical standards.

The Bank of England has signalled recently that it may be prepared to tolerate above-target inflation for longer, while growth remains weak. Three members of its monetary policy committee -- including outgoing Governor Mervyn King -- voted at its last meeting to expand its bond-buying program.

They were outvoted, but the previous time the committee split 6-3, the bank followed up at its next meeting with more monetary stimulus.

Related: Europe: No retreat from austerity

Osborne said Germany and Canada -- the only big economies still with AAA-ratings from all three major agencies -- had taken advantage of better times before the financial crisis to reduce deficits and make their economies more competitive, while Britain had built up the biggest structural deficit of all.

"Now we have no choice but to continue the hard work of putting our house in order," he wrote. ![]()

First Published: February 25, 2013: 7:23 AM ET

Judge rules against Apple in Einhorn cash fight

Written By limadu on Minggu, 24 Februari 2013 | 21.29

NEW YORK (CNNMoney)