Click for more market data.

Click for more market data. NEW YORK (CNNMoney)

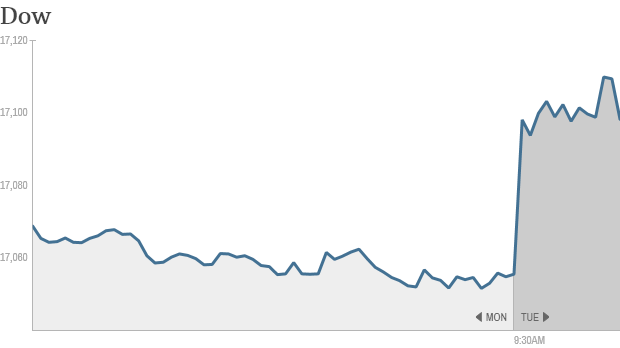

The Dow Jones industrial average rose to a new all-time high Tuesday (17,120), but then retreated to about 0.1% gains. The S&P 500 is now flat, and the Nasdaq is down 0.25% on the tech stock concern.

Here's what you need to know:

Midterm Fed report: Federal Reserve Chair Janet Yellen is giving her semiannual monetary policy report to the Senate Banking Committee at 10 a.m. ET. Economic data has been improving, raising questions about whether the Fed will begin to moderate its supportive tone.

She opened her remarks reiterating the Fed's intention to keep interest rates at historic lows for awhile longer.

"We judge that a high degree of monetary policy accommodation remains appropriate," she said.

But investors were spooked by the Fed's monetary policy report today that warned about social media stocks.

"In aggregate, investors are not excessively optimistic regarding equities. Nevertheless, valuation metrics in some sectors do appear substantially stretched -- particularly those for smaller firms in the social media and biotechnology industries," the report said.

In economic news, the government said retail sales increased 0.2% in June from the month before. That was a smaller gain than expected, but economist said the report showed strength below the surface.

Related: Fear & Greed Index

Bank earnings: Goldman Sach (GS)and JPMorgan Chas w (JPM)ere the top gainers on the Dow after both reported quarterly earnings that beat analysts' expectations.

The results came one day after Citigrou (C)reported earnings that beat expectations and announced a $7 billion settlement with the federal government over mortgages it sold in the run-up to the financial crisis.

Related: JPMorgan earnings: Thanks, Main Street!

Johnson & Johnson (JNJ) also reported earnings that beat expectations. The maker of consumer health care products boosted its outlook for full-year earnings as well. But the stock was down more than 1%, making it the biggest drag on the Dow.

Tobacco tie up: Reynolds American (RAI) and Lorillard (LO) announced plans to merge in a cash-and-stock transaction valued at $27.4 billion. Under the terms of the deal, Reynolds will sell certain brands and assets to Imperial Tobacco, while British Tobacco will maintain its stake in Reynolds.

Shares of Reynolds and Lorillard had rallied ahead of the widely-anticipated merger, but both stocks were down sharply after the news came out.

Related: Betting $27 billion on cigarettes

Stock market movers -- Boeing, Valero Energy: Shares in Boeing (BA) were up as the planemaker and its main rival Airbus woo customers at the aviation industry's biggest annual gathering. Valero (VLO) shares were down nearly 3% after the oil refiner told investors that quarterly earnings would come in below market expectations.

Michael Kors (KORS) stock fell on a negative analyst report.

Related: CNNMoney's Tech30

Overseas markets: European markets were slipping lower, after Germany's ZEW index of investor sentiment came in weaker than expected. Concerns about Portugal's Banco Espirito Santo also weighed on European markets. BES shares plunged amid concerns that a company linked to the troubled bank might miss a debt payment. But the stock recovered later in the day following upbeat comments from its CEO.

Asian markets were mixed.

First Published: July 15, 2014: 9:47 AM ET

Anda sedang membaca artikel tentang

Fed warns social media stocks 'stretched'

Dengan url

http://sepakgajah.blogspot.com/2014/07/fed-warns-social-media-stocks-stretched.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Fed warns social media stocks 'stretched'

namun jangan lupa untuk meletakkan link

Fed warns social media stocks 'stretched'

sebagai sumbernya

0 komentar:

Posting Komentar